SambaSmart

Description of SambaSmart

SambaSmart is a mobile banking application designed to provide convenience and a range of features for both Samba account holders and non-account holders. This app is available for the Android platform, allowing users to manage their banking needs with ease and efficiency. The unique functionalities of SambaSmart cater to a diverse audience looking for quick and secure banking solutions.

The application boasts an intuitive interface that simplifies the banking experience. Users can manage multiple accounts, including individual and sole proprietor accounts, all in one place. Checking account balances and viewing transactions is straightforward, enabling users to stay updated on their financial status. The app also allows seamless transfers between Samba accounts, making internal banking operations efficient.

A standout feature of SambaSmart is its integration of a Financial ChatBoT. This innovative tool allows users to perform financial transactions through conversational interactions, providing a modern and engaging way to manage banking tasks. Users can engage with the ChatBoT to request funds, make payments, or inquire about account details, ensuring assistance is just a message away.

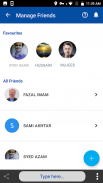

SambaSmart enhances user connectivity by enabling the addition of friends from the local address book. This feature allows users to connect with both Samba account holders and non-customers, facilitating secure transactions among friends and family. Users can send requests for fund transfers, bill payments, and mobile top-ups directly to their contacts, streamlining the process of managing shared expenses.

Notifications play a critical role in the app's functionality. Users have the option to control notifications across devices, receiving instant alerts for various activities. This includes notifications when logging in, receiving friend requests, or getting payment and transfer requests. Such timely updates help users stay informed about their banking activities without having to constantly check the app.

SambaSmart prioritizes security with multiple layers of protection. Users can log in using a fingerprint, username, and password, in combination with a session-based iPIN that is sent to their registered mobile number and email address. This robust security framework ensures that users' financial information remains safe and secure during transactions.

The app also provides essential banking functionalities such as bill payments and mobile top-ups. Users can manage their beneficiaries and billers effectively, facilitating quick payments to service providers. Additionally, the option to temporarily block and unblock debit cards offers users peace of mind in case of lost or stolen cards. Changing ATM PINs can also be accomplished easily through the app, adding to the overall convenience of managing banking tasks.

Finding nearby Samba ATMs and branches is made simple with the app's location feature. Users can easily search for the nearest banking services, ensuring they have access to physical locations when needed. This is particularly useful for customers who prefer face-to-face banking services or require assistance with specific banking tasks.

Registration for the app is designed to be user-friendly. Existing SambaClick customers can log in directly, while new Samba Bank customers can register within the app without needing to visit a branch. Non-customers can also join by providing basic information along with a CNIC picture, making the app accessible to a wider audience.

SambaSmart offers a comprehensive suite of tools designed to enhance the banking experience. With its focus on user convenience, security, and innovative features, the app stands out as a significant development in mobile banking. By enabling easy management of accounts, facilitating secure transactions among friends, and providing instant notifications, SambaSmart ensures that users have everything they need for efficient banking at their fingertips.

The combination of modern technology with traditional banking services makes SambaSmart a valuable tool for users seeking a smarter way to manage their finances. As the app continues to evolve, it promises to deliver even more functionalities that align with the needs of its users, further establishing itself as a leading mobile banking solution.